Markets across the world are in a downward spiral, witnessing a sharp sell-off triggered by economic uncertainties, trade policies, and investor sentiment. Contrary to The Wire’s recent article, “Why is India’s Market Crashing When Global Markets are Booming?”, the reality is that global markets are not booming but instead experiencing a significant downturn, with trillions of dollars wiped out in market value.

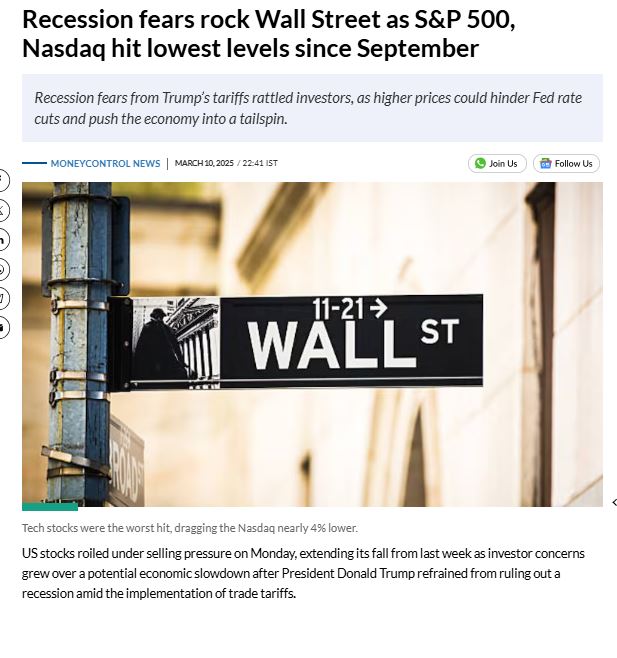

Massive Sell-Off in US Markets

The United States stock market has been hit hardest, with a $4 trillion market Wipeout since last month’s peak. The Nasdaq has officially entered correction territory, falling more than 10% from its December all-time high. Major indices such as the MSCI Global Stock Index also plunged over 2% in a single day, marking its worst drop since January 13.

Tech Sector Collapse

Even big tech stocks, which have been a major driver of global equity growth, are seeing steep declines:

- Tesla saw a shocking 15.4% drop.

- Nvidia, the AI-chip giant, declined over 5%.

- Meta, Amazon, and Alphabet also experienced major losses.

These numbers paint a stark contrast to the claim that global markets are thriving while India struggles.

- Asian and European Markets in Freefall

- The sell-off has not spared Asia and Europe either.

- Japan’s Nikkei 225 fell 2.5%,

- South Korea’s Kospi dropped 2.3%,

- Australia’s S&P/ASX 200 declined 1.8%.

Meanwhile, Europe’s STOXX 600 index closed 1.29% lower, further proving that global equities are struggling, not soaring.

Indian Markets Following Global Trends, Not Isolated

Indian stock markets opened lower on Tuesday, tracking the broader Asian sell-off. The Nifty 50 fell 0.51% to 22,345.95, while the Sensex lost 0.5% to 73,743.88. The Nifty 50 is currently trading 14.5% below its all-time high from September 2024, impacted by:

- Slowing earnings growth,

- Uncertainty around US tariffs, and

- Relentless foreign selling.

- Clearly, India’s market slump is not an anomaly but part of a worldwide trend.

Commodities and Cryptocurrency Crash

- Oil prices fell sharply due to tariff concerns and increased OPEC+ output.

- Gold, a traditional safe-haven asset, declined as investors took profits despite ongoing geopolitical uncertainty.

- Copper prices slipped by 1.25%, indicating reduced industrial demand.

- Bitcoin plummeted nearly 5%, hitting its lowest level since November.

- These declines underscore how market turmoil is widespread across multiple asset classes.

What’s Causing the Global Market Sell-Off?

The primary reasons for the sell-off include:

- US President Donald Trump’s trade policies and tariff-related uncertainties.

- Investor concerns about a possible US economic slowdown.

- Weak corporate earnings in key sectors.

- Foreign investors pulling out of emerging markets due to global economic concerns.

The Wire’s Misleading Narrative

The Wire’s claim that global markets are booming while India’s market alone faces turmoil is not supported by actual market data. The ongoing sell-off is a worldwide phenomenon, not an isolated event affecting India.

Instead of framing India’s market downturn as an exception, the reality is that Indian equities are moving in line with global trends—a result of the same macroeconomic pressures that are dragging down markets across the US, Europe, and Asia.

India’s stock market is not crashing in isolation. The Wire’s argument fails to acknowledge the broader economic landscape where global markets are facing steep declines, not booming. With US markets losing trillions, Asian markets tumbling, European indices falling, and commodities sinking, it is evident that India’s market downturn is part of a worldwide correction rather than a localized failure.

The global stock market is in turmoil, and ignoring these facts to push a misleading narrative does a disservice to investors looking for accurate analysis.

Author: Rishi Kalia is a seasoned entrepreneur, Digital media Strategist and political analyst with 23 years of diverse experience in business and public discourse. Tweets at Rishi Kalia